Exiting Coal

Coal is the most carbon-intensive of all fossil fuels, and our ability to tackle the climate crisis critically depends on the speed with which we phase out coal. However, the reality is that the global coal industry has continued to grow since the Paris Agreement was signed, with the world’s installed coal capacity increasing from 1,910 GW in 2015, to 2,126 GW in 2023.

This stands in stark contrast to the consistent warnings from the International Energy Agency (IEA): there is no room for new coal infrastructure if we are to limit global warming to 1.5°C, and that emissions from existing coal projects are enough to push the world above this limit. According to the IEA, this means that existing coal mines and power plants must be phased out entirely in OECD countries by 2030 and globally by 2040. Research by Urgewald shows that 95% of coal companies have no phase-out plan for coal and that 40% of companies have plans to expand their operations. To continue their operations and start new projects, coal companies need access to finance and investments. By stopping money flowing to the coal industry and redirecting the money to a just and green energy transition, financial institutions play a crucial role in succeeding with the coal-phase out that the world urgently needs.

A win for people and nature

Phasing out coal would be a win not only for the climate, but also for public health and the environment. Burning coal releases toxic and carcinogenic pollutants into the air, water, and soil, putting workers and nearby communities at risk. This exposure increases the likelihood of cancer and severe respiratory diseases that can lead to premature death. A coal exit would help prevent these harms while protecting local ecosystems from lasting damage, benefiting both people and nature.

NORWAY MUST SHOW TRUE LEADERSHIP

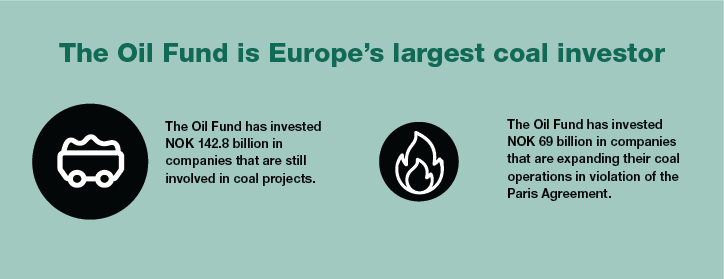

The Norwegian peoples pension fund, the Oil fund, continues to be Europe’s largest coal investor. Our most recent analysis shows that the Fund has 142,8 billion NOK in coal companies, with nearly half of the investments placed in companies planning to expand their operations.

These findings contradict Norway’s ambitions to withdraw from the industry and become an international climate leader. The Norwegian Parliament introduced a coal policy for the Fund in 2015 with the aim of pulling the Fund out of the coal industry, which was later strengthened in 2019. Since then, the climate crisis has become more urgent than ever, and coal investments have become far less desirable. Despite this, nothing has happened since 2019. In the meantime, nearly 100 financial institutions around the world have implemented coal policies that are far stronger than the Fund’s current policy. If Norway is serious about making the Oil Fund a leading financial institution on climate and finally exiting coal, the Norwegian Parliament urgently needs to strengthen the Fund’s coal exclusion criteria.

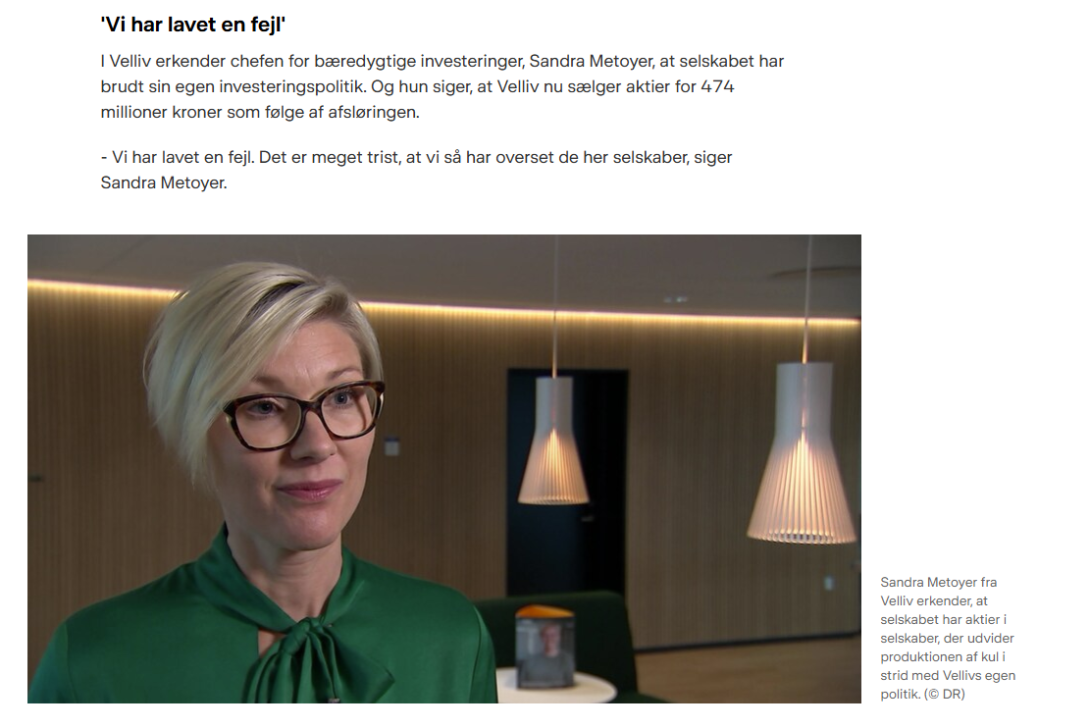

OUR IMPACT: SUBSTANTIAL COAL DIVESTMENT AMONG DANISH INVESTORS

In 2023, we analyzed the coal exposure of Danish pension funds and held meetings with them, asking for more ambitious coal criteria. We also discovered various coal investments in breach of several pension funds’ existing coal criteria. Our findings made headlines in one of Denmark’s biggest media and immediately resulted in coal divestments totaling half a billion Danish kroner. Following this, in early summer 2024, Denmark’s biggest pension fund, PFA, decided to tighten its coal criteria, leading to coal divestments amounting to nearly two billion Danish kroner.

PUBLICATIONS

The Oil Fund's last coal investments

May 2025

This analysis shows that the Oil Fund still has NOK 142 billion invested in the coal industry, despite the fact that it has been 10 years since a unanimous Parliament decided to phase out the Oil Fund's coal investments. This makes the fund Europe's largest coal investor.

Half of the investments are in companies that have plans to start new coal projects, in direct conflict with the goals of the Paris Agreement.

Banking on Thin Ice III

March 2025

This report provides the first ever overview of the financial relationships between 10 major Nordic banks and the fossil fuel industry, as well as the policies the banks have in place to regulaThis report shows, that while climate experts are issuing more and more dire warnings of what will happen if we fail to transition into a 1.5°C world, the biggest Nordic banks continue to pour billions of USD in financing and investments into coal, oil, and gas companies planning new fossil fuel projects that will bring this global climate goal out of reach.

Norway's coal secret

April 2024

This analysis shows that the Norwegian Oil Fund has invested a total of 189 billion NOK in coal companies, despite Norway's ambitions to be an international climate leader.

These investments are spread across 97 coal companies worldwide. 112 billion of the investments are placed in 47 companies that have expansion plans that contradict the goals of the Paris Agreement.

Danish pension funds climate failure

October 2023

This reports uncovers that 16 Danish pension funds have invested almost 25 billion DKK in the worst fossil fuel companies and their extraction of coal, oil, and gas. It also highligst significant differences in the climate behavior of the Danish pension funds. While PFA and Danica together account for 42% of the sector's most polluting investments, AP Pension and AkademikerPension only account for 1.3%.

Banking on thin ice II

November 2022

This report provides an overview of the financial relationships between 10 major Nordic banks and the fossil fuel industry, as well as the policies the banks have in place to regulate their links to the industry. From July 2020 – June 2022 the 10 banks have provided in total US$ 21.2 billion in loans and underwriting to the fossil fuel industry. Their total financing now amounts to US$ 89.7 billion since the adoption of the Paris Agreement.

Banking on thin ice I

February 2021

This report provides the first ever overview of the financial relationships between 10 major Nordic banks and the fossil fuel industry, as well as the policies the banks have in place to regulate their links to the industry.